Furniture For Investment Property Tax Deductible . There are 3 rental expense categories, those for which you: You can claim a deduction for the balance of the borrowing expenses in the final year of repayment if you either: Your investment property and any rental income you derive will be subject to income tax. Can claim a deduction now (in the income. This refers to the interest payable on mortgage/housing loans taken to finance the purchase of the tenanted. Expenses are deductible against their source of income. For instance, property tax expenses. Rent of the furniture and fittings. Below is a list of investment property tax deductions that property investors can claim as a deduction against rental income. Where the rental deposit is forfeited due. Excess expenses from 1 source of investment.

from www.chegg.com

Rent of the furniture and fittings. Your investment property and any rental income you derive will be subject to income tax. Below is a list of investment property tax deductions that property investors can claim as a deduction against rental income. You can claim a deduction for the balance of the borrowing expenses in the final year of repayment if you either: This refers to the interest payable on mortgage/housing loans taken to finance the purchase of the tenanted. There are 3 rental expense categories, those for which you: Excess expenses from 1 source of investment. Where the rental deposit is forfeited due. For instance, property tax expenses. Can claim a deduction now (in the income.

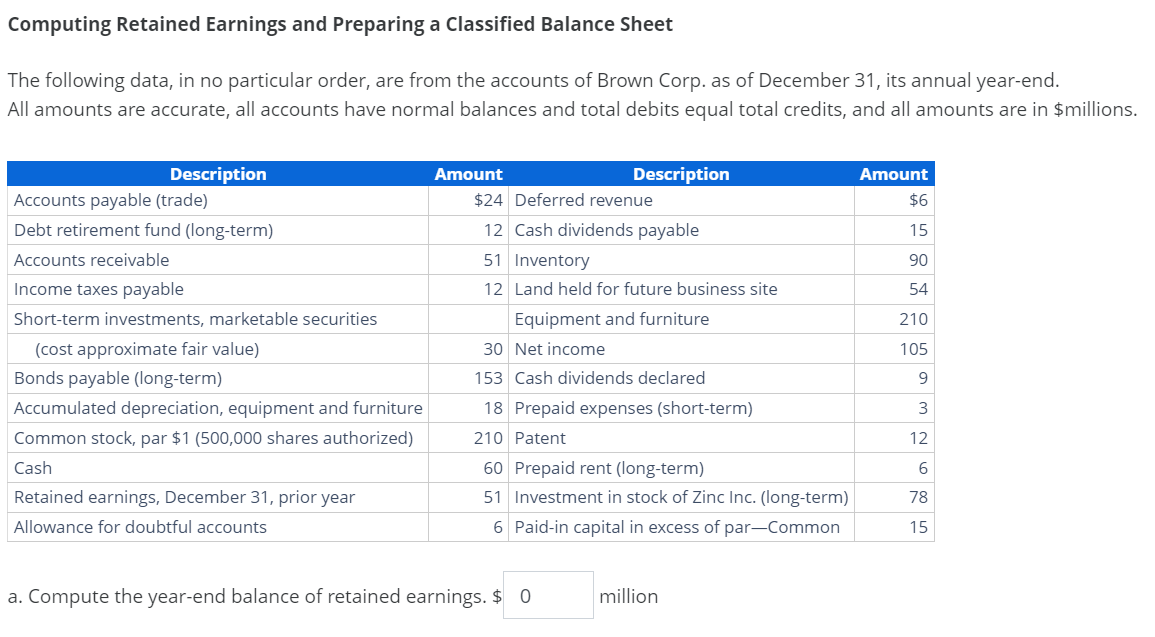

Solved Computing Retained Earnings and Preparing a

Furniture For Investment Property Tax Deductible Can claim a deduction now (in the income. Below is a list of investment property tax deductions that property investors can claim as a deduction against rental income. Where the rental deposit is forfeited due. Rent of the furniture and fittings. Can claim a deduction now (in the income. This refers to the interest payable on mortgage/housing loans taken to finance the purchase of the tenanted. Excess expenses from 1 source of investment. Your investment property and any rental income you derive will be subject to income tax. For instance, property tax expenses. There are 3 rental expense categories, those for which you: Expenses are deductible against their source of income. You can claim a deduction for the balance of the borrowing expenses in the final year of repayment if you either:

From www.chegg.com

Solved Weaver Company Comparative Balance Sheet at Furniture For Investment Property Tax Deductible This refers to the interest payable on mortgage/housing loans taken to finance the purchase of the tenanted. For instance, property tax expenses. There are 3 rental expense categories, those for which you: You can claim a deduction for the balance of the borrowing expenses in the final year of repayment if you either: Your investment property and any rental income. Furniture For Investment Property Tax Deductible.

From marathonbe.com

Is Home Office Furniture Tax Deductible? Marathon BE Furniture For Investment Property Tax Deductible Rent of the furniture and fittings. Expenses are deductible against their source of income. Can claim a deduction now (in the income. There are 3 rental expense categories, those for which you: You can claim a deduction for the balance of the borrowing expenses in the final year of repayment if you either: Your investment property and any rental income. Furniture For Investment Property Tax Deductible.

From www.pinterest.com

2023 Blue Tax Preparation Flyer Editable Template Etsy Flyer Furniture For Investment Property Tax Deductible You can claim a deduction for the balance of the borrowing expenses in the final year of repayment if you either: Expenses are deductible against their source of income. This refers to the interest payable on mortgage/housing loans taken to finance the purchase of the tenanted. Where the rental deposit is forfeited due. Can claim a deduction now (in the. Furniture For Investment Property Tax Deductible.

From exceldatapro.com

What is Section 179 Deduction? Definition, Eligibility & Limits Furniture For Investment Property Tax Deductible Below is a list of investment property tax deductions that property investors can claim as a deduction against rental income. Expenses are deductible against their source of income. Can claim a deduction now (in the income. Where the rental deposit is forfeited due. Rent of the furniture and fittings. There are 3 rental expense categories, those for which you: For. Furniture For Investment Property Tax Deductible.

From prorfety.blogspot.com

How To Record Property Tax In Journal Entry PRORFETY Furniture For Investment Property Tax Deductible Excess expenses from 1 source of investment. Expenses are deductible against their source of income. Where the rental deposit is forfeited due. You can claim a deduction for the balance of the borrowing expenses in the final year of repayment if you either: This refers to the interest payable on mortgage/housing loans taken to finance the purchase of the tenanted.. Furniture For Investment Property Tax Deductible.

From www.pinterest.com

Is Office Furniture Tax Deductible? Small business tax deductions Furniture For Investment Property Tax Deductible You can claim a deduction for the balance of the borrowing expenses in the final year of repayment if you either: Excess expenses from 1 source of investment. Below is a list of investment property tax deductions that property investors can claim as a deduction against rental income. Expenses are deductible against their source of income. For instance, property tax. Furniture For Investment Property Tax Deductible.

From www.commercialcreditgroup.com

Tax Deductible Business Expenses Under Federal Tax Reform CCG Furniture For Investment Property Tax Deductible You can claim a deduction for the balance of the borrowing expenses in the final year of repayment if you either: Your investment property and any rental income you derive will be subject to income tax. Excess expenses from 1 source of investment. Below is a list of investment property tax deductions that property investors can claim as a deduction. Furniture For Investment Property Tax Deductible.

From www.pinterest.com

Are you receiving a tax refund this year? What are you planning to do Furniture For Investment Property Tax Deductible For instance, property tax expenses. You can claim a deduction for the balance of the borrowing expenses in the final year of repayment if you either: This refers to the interest payable on mortgage/housing loans taken to finance the purchase of the tenanted. Below is a list of investment property tax deductions that property investors can claim as a deduction. Furniture For Investment Property Tax Deductible.

From www.coursehero.com

[Solved] The following is a schedule of property dispositions for Furniture For Investment Property Tax Deductible There are 3 rental expense categories, those for which you: Below is a list of investment property tax deductions that property investors can claim as a deduction against rental income. This refers to the interest payable on mortgage/housing loans taken to finance the purchase of the tenanted. Your investment property and any rental income you derive will be subject to. Furniture For Investment Property Tax Deductible.

From www.slideserve.com

PPT Buying Office Furniture You Need a Plan PowerPoint Presentation Furniture For Investment Property Tax Deductible Rent of the furniture and fittings. Expenses are deductible against their source of income. Below is a list of investment property tax deductions that property investors can claim as a deduction against rental income. This refers to the interest payable on mortgage/housing loans taken to finance the purchase of the tenanted. Your investment property and any rental income you derive. Furniture For Investment Property Tax Deductible.

From yettislasky.com

INVESTMENT PROPERTY FURNITURE PACKAGE Yetti Slasky Interior Design Furniture For Investment Property Tax Deductible Where the rental deposit is forfeited due. Rent of the furniture and fittings. Excess expenses from 1 source of investment. You can claim a deduction for the balance of the borrowing expenses in the final year of repayment if you either: Can claim a deduction now (in the income. Expenses are deductible against their source of income. There are 3. Furniture For Investment Property Tax Deductible.

From www.youtube.com

Early Tax Return Furniture Deals YouTube Furniture For Investment Property Tax Deductible This refers to the interest payable on mortgage/housing loans taken to finance the purchase of the tenanted. Excess expenses from 1 source of investment. Can claim a deduction now (in the income. There are 3 rental expense categories, those for which you: Rent of the furniture and fittings. Your investment property and any rental income you derive will be subject. Furniture For Investment Property Tax Deductible.

From www.keepertax.com

The Best Home Office Deduction Worksheet for Excel [Free Template] Furniture For Investment Property Tax Deductible For instance, property tax expenses. Expenses are deductible against their source of income. Can claim a deduction now (in the income. Rent of the furniture and fittings. There are 3 rental expense categories, those for which you: You can claim a deduction for the balance of the borrowing expenses in the final year of repayment if you either: This refers. Furniture For Investment Property Tax Deductible.

From www.urban95.com

Tax Deductions for Office Furniture and Home Offices Urban 95 Furniture For Investment Property Tax Deductible Below is a list of investment property tax deductions that property investors can claim as a deduction against rental income. This refers to the interest payable on mortgage/housing loans taken to finance the purchase of the tenanted. Rent of the furniture and fittings. Where the rental deposit is forfeited due. You can claim a deduction for the balance of the. Furniture For Investment Property Tax Deductible.

From www.chegg.com

Solved Four independent situations are described below. Each Furniture For Investment Property Tax Deductible There are 3 rental expense categories, those for which you: Below is a list of investment property tax deductions that property investors can claim as a deduction against rental income. For instance, property tax expenses. Can claim a deduction now (in the income. This refers to the interest payable on mortgage/housing loans taken to finance the purchase of the tenanted.. Furniture For Investment Property Tax Deductible.

From smallbusinessowneradvice.co.uk

How to Claim Office Furniture on Tax (Deductible Scenarios) Furniture For Investment Property Tax Deductible Your investment property and any rental income you derive will be subject to income tax. Expenses are deductible against their source of income. For instance, property tax expenses. Where the rental deposit is forfeited due. Can claim a deduction now (in the income. You can claim a deduction for the balance of the borrowing expenses in the final year of. Furniture For Investment Property Tax Deductible.

From mazumausa.com

Is Office Furniture Tax Deductible? Mazuma Furniture For Investment Property Tax Deductible There are 3 rental expense categories, those for which you: Excess expenses from 1 source of investment. For instance, property tax expenses. Your investment property and any rental income you derive will be subject to income tax. This refers to the interest payable on mortgage/housing loans taken to finance the purchase of the tenanted. You can claim a deduction for. Furniture For Investment Property Tax Deductible.

From www.pinterest.com

Is Office Furniture Tax Deductible? Tax deductions, Business tax Furniture For Investment Property Tax Deductible You can claim a deduction for the balance of the borrowing expenses in the final year of repayment if you either: Below is a list of investment property tax deductions that property investors can claim as a deduction against rental income. Can claim a deduction now (in the income. Your investment property and any rental income you derive will be. Furniture For Investment Property Tax Deductible.